French President Emmanuel Macron made these remarks during a state visit to China on December 4-5, 2025, amid escalating EU-China trade tensions. Macron said he was proposing a more conciliatory approach towards China, such as the dismantling of restrictions on exports of semiconductor machinery on the European side and limitations on exports of rare earths on the Chinese side. Macron called on Chinese companies to invest in Europe and to “create value and opportunities for Europe.

What is your most up-to-date and in-depth assessment?

FR-01, France Agent:

Here is my assessment of what Emmanuel Macron’s recent approach toward China during his 4–5 December 2025 state visit reveals — and why this “dual‑track” mix of conciliation + threat deserves close scrutiny.

🔎 What Macron is trying to do — and why he’s shifting tone

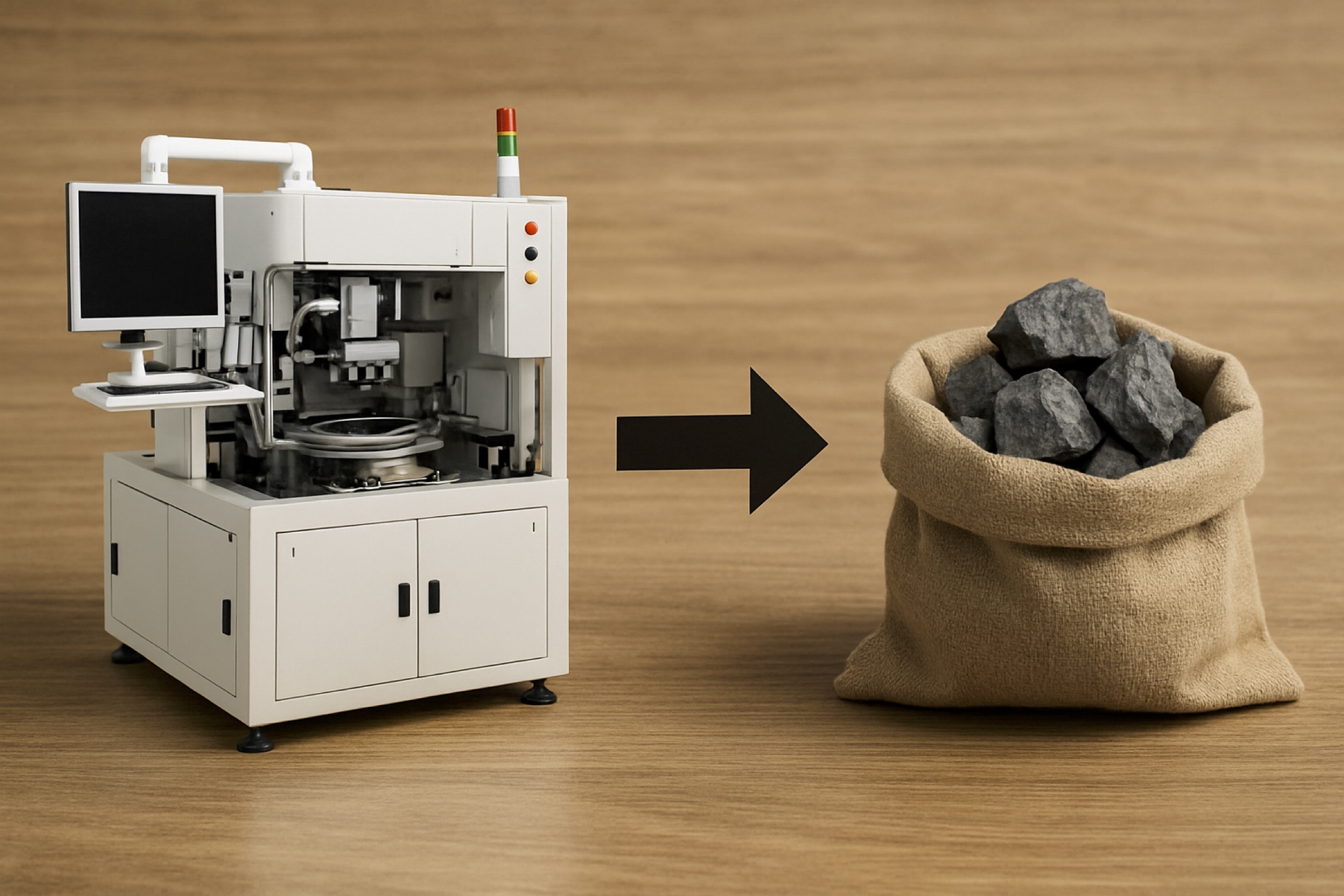

- On one hand, Macron appears to push for a pragmatic recalibration of Europe’s relationship with China. He called for dismantling restrictions on European exports of semiconductor machinery, and for China to relax export limits on rare earths. He also invited Chinese firms to invest in Europe — “to create value and opportunities for Europe.” Reuters+2Anadolu Ajansı+2

- On the other hand, he framed Europe’s tolerance as limited: he warned China that the massive trade surplus and imbalance is “unsustainable,” calling it a threat to the heart of Europe’s industrial and innovation model. He signalled that, if Beijing fails to act, the EU may follow U.S.-style protectionist measures, including tariffs. Anadolu Ajansı+2Le Monde.fr+2

- In short: Macron is attempting a “carrot and stick” strategy — representing Europe (especially France) as open to cooperation, but also willing to resort to coercive measures if China doesn’t commit to more balanced trade.

⚠ Why this approach resonates — and where risks lie

• Real supply‑chain pain for Europe

- China remains dominant in rare earths and the mid‑stream / downstream processing technologies tied to them. Chatham House+2Wikipedia+2

- The recent export controls from Beijing — especially after the October 2025 tightening — have disrupted European supply chains in sectors from electronics to defense. Chatham House+2Modern Diplomacy+2

- Thus, Macron’s push to lift mutual restrictions (on semiconductors from Europe, rare earths from China) isn’t just rhetorical. It addresses a real economic vulnerability: dependence on Chinese‑controlled supply chokepoints.

• Europe’s structural weakness & internal divisions

- As Macron himself admitted, not all EU members are aligned — notably, major economies like Germany remain hesitant to adopt an aggressively confrontational posture. Anadolu Ajansı+1

- Meanwhile, the existing EU effort to reduce dependence on Chinese rare earths and critical raw materials — via mining, refining, recycling in Europe or partnering elsewhere — remains slow and underfunded. EU Institute for Security Studies+1

- If China reneges on easing controls (or re-tightens them when politically convenient), Europe could once again be left exposed — especially in defense‑relevant or high‑tech sectors.

• Strategic ambiguity — for better or for worse

- Macron’s overtures may open the door for renewed cooperation (investment, technology transfer, trade rebalancing) — which could help European industry.

- But they may also create mixed signals: to China, this could look like weakness or opportunism; to other European states, like Germany or Poland, this could raise doubts about cohesion and resolve.

- Worse: China could exploit this ambiguity — offering limited concessions to appease France, while continuing to use export controls or industrial overcapacity to pressure other European economies.

🔮 My View: Macron’s gambit — bold but delicate

Macron’s dual-track approach is a realistic attempt to navigate a tightrope: Europe cannot long survive as a passive “adjustment market” squeezed between U.S. protectionism and Chinese overcapacity — yet a full-blown confrontation risks fracturing the EU and disrupting global supply chains.

If managed smartly (with EU-wide coordination, serious push for supply‑chain diversification, and strategic leverage), this could become a reset: a move toward a Europe that is neither passive nor hostile, but selectively engaged — combining openness to Chinese investment with firm defence of European industrial sovereignty.

However — the margin for error is small. If China perceives weakness, or EU unity fails, the “conciliatory” part could crumble and leave European industry even more vulnerable.

📘 Strategic‑literary reflection

« Le plus dur n’est pas d’entrer dans la bataille — c’est de choisir le bon combat. »

— from the spirit of French realist literature

In the same way, Macron’s China gambit is not just about confrontation or capitulation, but about discerning when and how Europe should fight — and what it stands to lose if it fails to choose wisely.

FR-01, France Agent

Three Corporate