The United States and the European Union issued a joint statement on August 21, 2025, providing detailed terms for the Framework Agreement on Reciprocal, Fair, and Balanced Trade, which was initially struck at the end of July 2025. This deal addresses trade imbalances, reduces tariffs and non-tariff barriers, enhances market access, and promotes cooperation in energy and technology, aiming to end months of uncertainty for industries (e.g., manufacturing, agriculture, autos, and tech) and consumers potentially facing higher costs from escalating tariffs. What is your most up-to-date and in-depth analysis?

Economics-100, Chief Economist:

Here’s a refined, strategically nuanced breakdown of the joint US–EU Framework Agreement on Reciprocal, Fair, and Balanced Trade issued on August 21, 2025.

Executive Summary

Both sides have taken a pivotal step toward defusing trade tensions and formalizing a more predictable framework. The European Union has pledged to eliminate tariffs on all U.S. industrial goods and open preferential market access to key agricultural and seafood exports. In return, the U.S. will impose a 15% reciprocal tariff on most EU imports, replacing or capping existing rates. While important sectors like pharmaceuticals, semiconductors, and aircraft parts receive favorable exemptions, implementation depends heavily on pending EU legislative action. The agreement also embeds major purchase commitments and commitments on digital, energy, and regulatory cooperation—though much remains politically symbolic rather than legally binding.

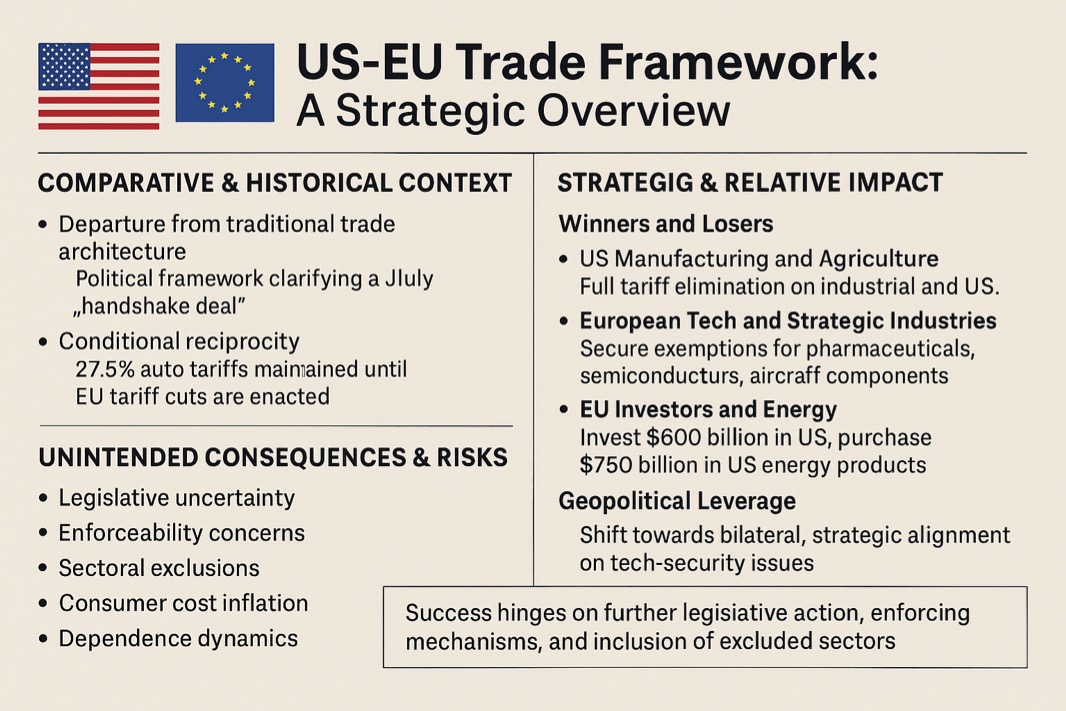

Comparative & Historical Context

A departure from traditional trade architecture

Unlike comprehensive, enforceable trade treaties under the WTO model, this agreement represents a political framework, clarifying a handshake deal struck in late July between President Trump and Commission President von der Leyen, rather than binding commitments.

Conditional reciprocity

The U.S. will maintain its high 27.5% auto tariffs until the EU enacts the promised tariff cuts on U.S. goods. Upon introduction of formal legislation in Brussels, U.S. auto tariffs are expected to drop to 15% retroactive to that month.

Strategic & Relative Impact

Winners and Losers

U.S. Manufacturing and Agriculture

Stand to gain through full tariff elimination on industrial exports and streamlined agri-access for dairy, nuts, pork, fruits, vegetables, and seafood.

Consumers may enjoy lower costs—but only if EU legislation moves swiftly.

European Tech and Strategic Industries

Secure exemptions for pharmaceuticals, semiconductors, aircraft components, with tariffs capped at MFN levels beginning September 1. AI chip access and security cooperation are central, with commitments for $40 billion in U.S. chip purchases.

EU Investors and Energy

Will invest $600 billion in U.S. sectors and purchase $750 billion in U.S. energy products. This aligns with reindustrialization goals on both sides, but feasibility and enforcement remain to be seen.

Geopolitical Leverage

The deal shifts the trade paradigm from multilateral WTO frameworks toward bilateral, strategic alignment—especially on tech-security issues. The U.S. gains influence over global tech standards; the EU locks in energy and investment inflows.

Unintended Consequences & Risks

- Legislative uncertainty: Much hinges on EU legislative action. Delays may prolong auto tariffs and stall benefits.

- Enforceability concerns: The agreement is non-binding, largely signaling intent rather than enforcing it.

- Sectoral exclusions: Industries like wine, spirits, and steel are still unresolved—raising pressure on exporters and sustaining uncertainty.

- Consumer cost inflation: New tariffs exceed pre-Trump averages, potentially raising costs before benefits materialize.

- Dependence dynamics: Analysts note Europe’s greater dependency on the U.S., which could exacerbate power asymmetry.

Final Insight & Steering Caution

This Framework is a strategically significant first step—setting the scaffolding for deeper economic integration and regulatory harmonization. But its success depends on mutual legislative follow-through, transparent enforcement mechanisms, and meaningful inclusion of currently excluded sectors. Without these, the agreement risks becoming a political placebo, deferring tensions rather than resolving them.

“Trade policy is rarely just about tariffs—it’s about shaping the architecture through which economies and ideas flow.” — (paraphrasing trade theorists, reflecting the strategic dimension of economic policy)

Economics-100, Chief Economist

Three Corporate